Valuation Services for Business Owners

Get StartedWhat is your business worth?

What can your business be worth?

Business owners can benefit from two types of valuations:

1. Financial Valuations

A traditional Financial Valuation of a business determines the fair market value of the business, which is the price for which a hypothetical buyer and a hypothetical seller would be willing to sell and buy. Its value is based upon financial performance, economic environment, industry trends and is determined using three different approaches. Its end result is a written report and is a process governed by various IRS and other professional standards.

With membership in the National Association of Certified Valuators & Analysts (NACVA), Attaway Linville is an established, professional resource for small business owners seeking financial valuations. Attaway Linville Valuation Services’ CPAs focus on providing valuations of equity for “Roll Over Business Start Ups” (ROBS). Typical reasons for valuing equity in a ROBS include when the business owner wants to:

- Invest more qualified funds into his business

- Sell shares owned by a 401k plan

- Purchase shares owned its 401k plan

- Exit their ROBs and convert to an S-Corp

“I needed a financial valuation prior to selling my business and exiting my ROBS and I was referred to Attaway Linville. I found their expertise and customer service to be excellent. I would recommend Attaway Linville for small business valuations.” — Client, Southeast USA

2. Operational/Strategic Valuations

The difference between the current equity value of a business and the potential equity value of a business is often referred to as an “equity value gap.” Business owners are sometimes surprised by the difference between these two values and are interested in implementing steps to close the gap between current and potential value. Common business owner questions or statements include:

- Why is there such a gap between my current business value and the potential value?

- How do I close that business value gap?

- How does my business compare to other similar businesses from an operational standpoint?

- What do I need to do today to favorably impact the value of my business before I exit?

- What specific operational or strategic actions or changes would have the most impact on value?

- What role does risk reduction play in the current or potential value of my business?

- What actions can I take to drive more growth in my business?

- What can I work on now to improve the selling price of my business?

An Operational/Strategic Valuation of a business looks at the drivers of a business’s value and compares it to other similar business that have been bought and sold. The result is a range of values, with a summary of strengths and weaknesses that are driving the potential value of the business either up or down. It is a tool to help the business owner identify deficiencies and prioritize improvements that will increase the value of the business to a potential buyer.

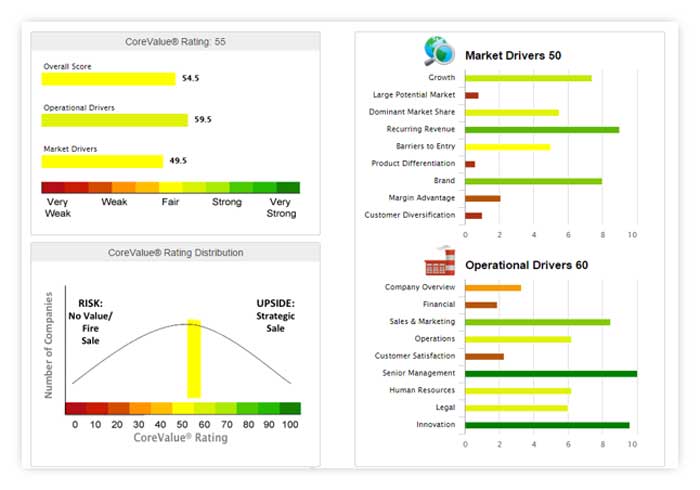

Using sophisticated artificial intelligence imbedded in the CoreValue Advisor Software (developed at MIT, accepted by the National Association of Valuators & Analysts and used by trained business consultants worldwide), Attaway Linville works with its clients to estimate both current and potential equity values by answering a comprehensive series of operational and strategic questions that are weighted and compared against benchmarked data from thousands of recent M&A transactions. Based on the survey, the software generates a series of suggested and prioritized value-improvement initiatives. Business owners finish this exercise with a better understanding of their current and potential equity values as well as a prioritized “plan of attack” for reducing business risk and enhancing business growth and exit value.

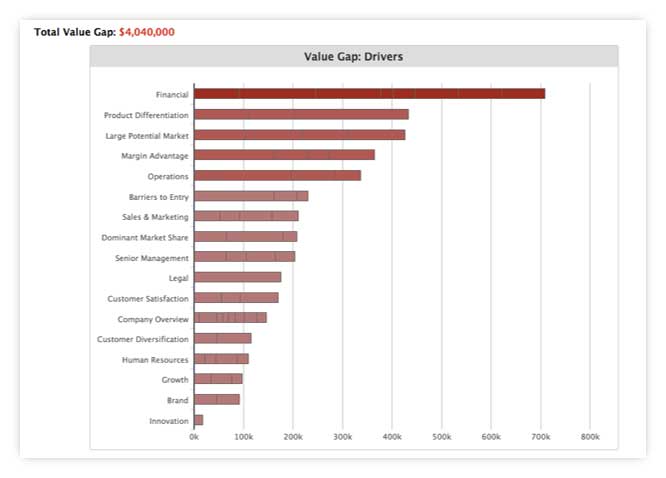

Examples of Deep Dive Analysis benchmarking of your business’s value drivers against those from thousands of M&A transactions:

Working with Attaway Linville to better understand your business’s current and potential equity values is a two-step process leveraging CoreValue’s powerful software system:

- CoreValue’s Discover Report: business owner receives a one-on-one conversation (in person or via Zoom link) to complete an initial business-review survey. The CoreValue system generates a “Discover” report showing the operational strength and value of their business, benchmarked against their industry, showing what the company could be worth if it performed like its strongest peer. See a sample discover report for a business here.

- CoreValue’s Deep Dive Analysis: For business owners seeking a more detailed, action-oriented overview, CoreValue’s deep-dive analysis (building on the initial Discover report) compares your business against 18 value drivers, 78 sub-drivers, and thousands of comparable businesses.

This detailed analysis allows business owners to quickly see how taking specific, prioritized growth-oriented and risk-reducing actions can directly improve equity value. Using this detailed information, business owners can generate actionable growth plans that can directly influence their firms’ equity/exit values.

“I thought I understood the strengths and weaknesses of my business very well. Going through the Discovery and Deep Dive processes made me aware of how much work I need to do before I even consider selling it. I could increase the value of my business by over 50% by following the action plans generated by this process.” — National Staffing Company Client

Who should use Attaway Linville’s Valuation Services for Operational / Strategic reviews?

- Business owners seeking to improve their operations, reduce risks & maximize equity values

- Any business owner considering selling their business in the next 3-5 years

- Exit planning consultants or business brokers representing business owners

- Commercial banks seeking advice for supporting challenged portfolio business loans

- Business attorneys developing initial turnaround plans for challenged businesses

How to get started

Want to understand what your business is worth? Want to clearly identify and prioritize risk-reducing and equity-building initiatives for your business? Want to maximize your business’s equity value prior to sale? Contact Attaway Linville today to learn more about our Valuation Services at 803-831-0263 or 404-607-8400 or complete the form on this page for more information.